As the insurance industry evolves, dealing with more complex claims, recognizing more sophisticated fraud, and adjusting to increasing customer demands, the technology we use must too. Adjusters can now count on AI and machine learning to help them with difficult claims and fraud recognition.

At n2uitive we believe that this technology also needs to work when insurance adjusters are out in the field. Here we examine why it matters and how n2record can help.

The Evolving Role of Claim Adjusters

Claim adjusters no longer just deal with paperwork, they now need to have tech skills, be a good, empathetic listener to customers, and manage high workloads. Their role has evolved due to talent shortages in the insurance industry and evolving customer expectations.

They also spend a lot of time out in the field, so using technology that is fixed (such as a fixed computer with insurance hardware), won’t be helpful. So using tablets, laptops, and mobile apps will make a big difference to their productivity.

The Critical Value of Recorded Statements

When out in the field, claim adjusters are often taking recorded statements.

Statements are key to the claims process. It provides the basis to each individual claim and is analyzed with a fine tooth comb when fraud is suspected.

Managing your recorded statement throughout the claims process is important, you need to be able to:

- Capture your recording clearly

- Save it easily

- Check it efficiently

- Find the recording fast when needed

- Share it with colleagues and stakeholders simply

- Simplify transcription

Using an app or software to manage your statements can help you with the points above.

Navigating Challenges in Claims Processing

Managing claims can be tough, you’re often managing multiple systems and dealing with complicated claims.

- Multiple systems: Many companies (not just in the insurance industry) now have lots of different softwares for different areas that don’t communicate. So you end up with employees who waste time looking for information in several systems, increasing frustration and decreasing productivity.

- Multiple departments: One claim can also go through 2 or 3 departments before it reaches its conclusion. This process can lead to confusion and more than one person working on the same claim at once. It’s also confusing to customers who can’t accurately track their claim.

- Outdated technology: Many insurance companies that we speak to use outdated technology to manage claims. This issue leads to an IT department spending more time maintaining the software rather than focusing on improvements for the company. Adjusters can also struggle to manage claims efficiently as they’re fighting ineffective technology.

Our blog 8 claims management problems and their solutions dive into the solutions to these issues in more depth.

The Demand for a Unified Mobile Solution

Finding a solution that also works when in the field increases productivity. If you choose a solution that doesn’t work effectively on mobile devices, you’re increasing inefficiency as well as the cost of providing multiple devices for your adjusters to complete a claim. It also increases the time needed to process a claim if statements aren’t available instantly from anywhere.

Look for an option that provides a reliable, easy to use mobile app to improve usability and increase productivity when on the road.

Introducing n2record Mobile by n2uitive

We saw how much insurance adjusters struggled with outdated tech that didn’t work on their phones or recording statements directly on their smartphones. This solution is very proactive, but it doesn’t protect sensitive data well and the whole claim process hangs on the adjuster remembering to upload the statement to the claims management system.

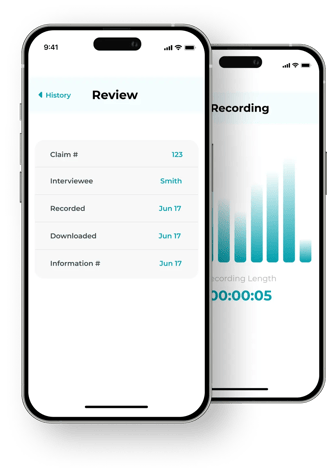

To solve this problem once and for all, we created n2record mobile, an iOS app that enables adjusters to take statements wherever they are. The audio file is then uploaded automatically to the n2uitive cloud-based system where it’s fully encrypted yet easy to locate and use at any moment during the claim process.

How n2record Mobile Enhances Claims Processing

Using n2record your fieldwork becomes streamlined and simplified. You only need your iPhone to be able to work efficiently. You can access past statements to work on claims from anywhere in the world. You can also record new statements from your phone without worrying about sharing them later.

All statements are easy to review, share, and transcribe, improving your productivity by up to 30%.

Getting Started with the Recorded Statement Mobile App

In our experience, adjusters begin taking statements within 48 hours of being onboarded. Our mobile app is easy to use, you don’t need any hardware or other apps to make it work.

It’s also available for free in the Apple Store, to learn more about how it can help your business, set up a call with us.

Revolutionizing Claims Management with Mobile Technology

Having a mobile app to help record and store statements simplifies workflows, improves productivity and efficiency. It helps to manage many challenges that insurance adjusters face and make their work less stressful.

Get in touch with us today to start using n2record mobile to enhance claims management efficiency and effectiveness.

.png?width=1600&height=700&name=CTA%20(2).png)