How Recorded Statement Intelligence™ Is Redefining Claims Investigation

See how n2uitive’s Statement Intelligence™ helps insurers turn recorded statements into searchable data that strengthens every claim investigation.

What trends are impacting insurance claims in 2025? Find key statistics and expert predictions to help you stay informed.

What will the insurance claims industry look like in 2025? Will AI speed up workflows or create new risks? Can insurers keep up with rising climate-related claims? How will economic pressures impact payouts and fraud prevention?

The industry is at a turning point, and 2025 is bringing big shifts in technology, risk, and regulation. Let’s take a look at the key statistics and trends shaping the future of claims management.

AI and automation are reshaping the way insurers handle claims, but adoption is still cautious and strategic. Right now, the focus is on improving efficiency. This means helping adjusters save time, reduce manual effort, and manage claims better.

Adjusters are often handling 150 to 200 claims at a time, balancing customer communication, claim tracking, and coordination with repair shops, medical providers, and other parties. AI tools are designed to support (not replace) adjusters. These tools can help them work faster without being bogged down by administrative tasks.

According to McKinsey, adjusters in 2025 will spend most of their time on complex and high-stakes claims, while more than half of claims processing activities will be handled by technology. AI tools such as automated customer service apps and workflow assistants will take over routine communication and data collection. This will allow adjusters to focus on the claims that require critical thinking and human expertise.

As insurers implement AI into their processes, data privacy and governance remain top concerns. Customer information is sensitive, and insurers must verify that AI solutions adhere to strict security protocols and compliance frameworks.

The National Association of Insurance Commissioners (NAIC) has set guidelines to address risks like biased algorithms, inaccurate decision-making, and improper data handling. Since the insurance industry is inherently risk-conscious, companies are cautiously adopting AI. Insurers want to make sure technology enhances, not undermines, claims processing integrity.

Policyholders expect fast, easy, and transparent claims experiences. Many prefer handling claims digitally to avoid long phone calls or paperwork. However, there’s mixed feelings about AI in insurance. Even though automation speeds up processes, consumers remain cautious of AI making critical decisions, especially when it comes to claim approvals and denials.

For insurers, the focus is on leveraging AI responsibly. They want to use it to improve their efficiency without compromising fairness. This means deploying AI for non-controversial applications like:

Ultimately, customers want one thing: to settle their claims quickly, fairly, and with minimal to no frustration. Whether insurers use AI, automation, or traditional adjuster-led processes, the key is ensuring a smooth and transparent experience.

Self-service options have been gaining traction for years. AI is making self-service claims faster, smarter, and more scalable, benefiting both policyholders and insurers.

That said, self-service will not entirely replace human interaction. Complex claims require human expertise, empathy, and deeper analysis.

The future of claims processing lies in a hybrid approach, where customers can choose between digital convenience and human assistance. Some will want to talk to an adjuster, while others will prefer to handle everything online. AI is simply making it easier and more efficient to provide both options.

Inflation and financial uncertainty have a direct impact on claims management. In a weaker economy, insurers face two major challenges:

Insurance companies rely heavily on investments, so during economic downturns, they tighten their focus on claim payouts to manage financial stability. When investment returns are strong, insurers absorb higher claim costs more easily. But in a weaker economy, claims expenses come under heavier review.

Industry Insight: McKinsey predicts that more than half of claims processing activities will be managed by technology, which will allow insurers to offset rising costs while improving efficiency.

Natural disasters are becoming more frequent and severe. Increasing natural phenomena creates higher claims volumes and rising losses for insurers. This has led to a shift in underwriting and claims management strategies, especially in high-risk areas.

For example, wildfires in California have caused insurers to pull back on home insurance coverage. Since insurance rates are set by state regulators, insurers can’t simply raise prices to match rising risks. If the cost of coverage outpaces what they’re allowed to charge, they often pull out of high-risk areas entirely. Homeowners and businesses are left with fewer coverage options and forcing states to step in with government-backed insurance programs.

Insurance is heavily regulated at the state level, and new policies around AI governance are being created to ensure consumer protection. The NAIC has issued guidance on AI compliance, third-party AI usage, and ethical decision-making in claims processing.

There’s a growing pressure to balance AI innovation with responsible data use. Insurers must verify that their AI-driven claims processes remain fair, transparent, and unbiased.

Companies are reviewing AI algorithms, improving compliance protocols, and increasing transparency in AI-assisted claims decisions to align with new regulations.

As AI becomes more integrated into claims workflows, insurers must confirm their automation systems improve efficiency without compromising trust.

As insurers prepare for 2025, here are three key trends shaping the future of claims management.

AI is no longer a distant concept in insurance. Insurers are figuring out how to use AI without adding new risks. Their main focus is on making processes more efficient and accurate.

The goal isn’t to replace adjusters, but to support them in processing claims faster, reduce manual workloads, and improve decision-making. Insurance companies are figuring out how to leverage AI for fraud detection, claims triage, and data analysis. At the same time, they want to make sure it elevates, rather than disrupts, the customer experience.

The insurance industry moves with the economy. A new U.S. administration brings policy shifts that, along with changing financial markets, require insurers to adjust their claims strategies.

Rising interest rates, inflation, and market volatility all influence how insurers handle payouts, fraud investigations, and financial reserves. To keep claims fair and transparent, insurers are exploring different ways to manage risk without compromising their service.

The insurance workforce is undergoing a major generational shift. Experienced adjusters are retiring, and insurers are struggling to attract and retain new talent.

To fight this, insurers are looking at technology as a way to bridge the gap. AI and automation can’t replace human expertise, but they can help new adjusters ramp up faster, eliminate manual tasks, and help them become more productive.

Insurers will need to strike a balance between AI efficiency and human judgment as they adapt to a shrinking talent pool.

New technologies bring new efficiencies, but only if you take the time to understand them. Sticking with familiar processes is easy, especially in a fast-paced environment. However, those who explore AI-driven tools, automation, and digital workflows will gain valuable efficiencies that will help them stay ahead of the competition.

The best way to understand how AI and automation can help is to try them firsthand. Whether it’s AI-powered documentation, self-service claims tools, or fraud detection software, hands-on experience is the fastest way to see the benefits. AI is here to help you work smarter and faster.

AI has a lot of potential, but it isn’t a one-size-fits-all solution. Knowing where AI adds value and where human expertise is still necessary helps you use technology in a way that you’re getting the most out of it.

Traditionally, recorded conversations have been difficult to search, analyze, and apply effectively in claims resolution.

As an adjuster, you have had to juggle multiple steps just to manage a single conversation, from recording and storing calls to transcribing them manually. These inefficiencies slow down the claims process and create inconsistency across teams.

n2uitive is changing that.

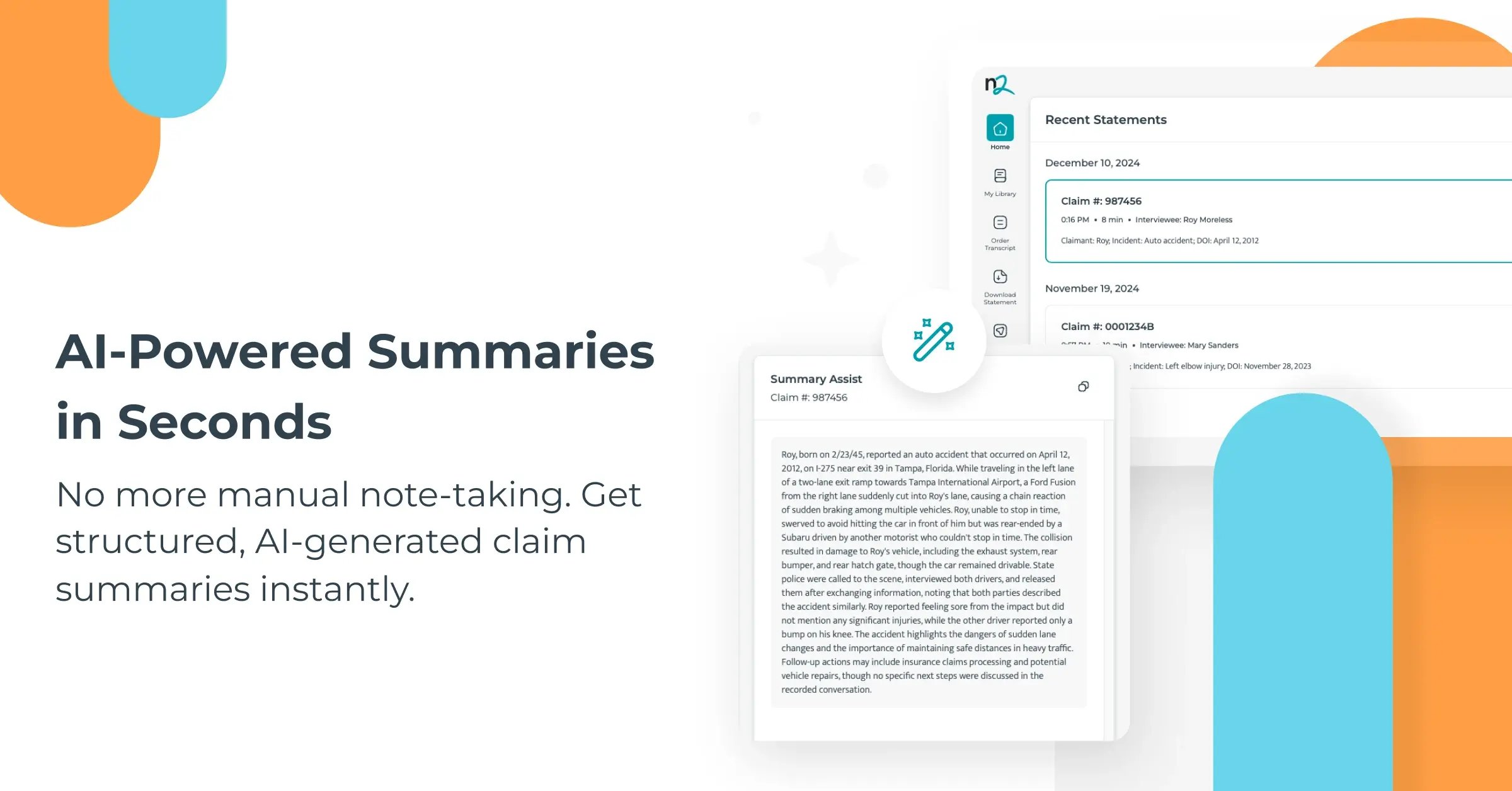

Instead of having to record, store, transcribe, and manually summarize conversations, n2uitive lets you automate and centralize these steps into a single, streamlined workflow.

With n2uitive, you can:

“Adjusters using n2uitive report significant time savings and a more reliable, consistent claims process. Their recorded statements are available whenever they need them. Plus, all statements are accurately documented and integrated into their claims workflow.”

–Joel Gendelman, CEO & Founder of n2uitive

How much time is your team losing to scattered, hard-to-find recorded statements? See how n2uitive helps 40+ insurers improve claims efficiency. Book your free demo today.

See how n2uitive’s Statement Intelligence™ helps insurers turn recorded statements into searchable data that strengthens every claim investigation.

Discover how Recorded Statement Lifecycle Management software streamlines and standardizes the recorded statement process for both efficiency and...

Fraud often starts in conversations, not claim forms. See how insurers are turning recorded statements into data that catches what models miss.